Venture Investors Shift To Healthcare, Abandon IT

Venture capitalists reopened their doors for business in the second quarter – at least a crack – but abandoned their traditional focus on information technology for healthcare.

Money placed with startups rebounded 32 percent from the first three months of the year to $5.3 billion, even as it fell 37 percent from the same quarter last year, according to Dow Jones VentureSource.

General partners appear to be convinced the Obama Administration’s push for healthcare reform will bear fruit. Investing in healthcare startups jumped to levels from before the financial crisis hit last fall.

Venture firms put $2.2 billion into healthcare portfolio companies, a remarkable 62 percent improvement from the first quarter and only a 14 percent decline from a year ago.

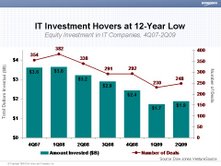

It was the first time healthcare investing surpassed that of information technology, where checks written to IT startups fell 41 percent. Leading the IT decline was the software sector. Investments fell 52 percent.

The information-technology total was the lowest in 12 years, according to VentureSource, and suggests the confidence in the high-tech economy hasn’t returned.

It also says something that is becoming increasingly obvious to policy makers in Washington and business people across the country: the economic rebound is going to be slow and painful.

0 Comments:

Post a Comment

<< Home